Entering 2024, the investment world is ripe with opportunities, particularly in the realm of growth stocks. Amidst this dynamic environment, AI-based solutions such as CollectGPT and JPMorgan’s IndexGPT are becoming crucial for developing investment strategies, a trend that is especially evident in Canada’s tech-infused financial sector.

Key Growth Stocks for 2024

The international market is abuzz with growth stocks poised for a significant impact in 2024. Highlighted below are some of the major contenders:

- AstraZeneca (AZN 3.41%): This pharma heavyweight is anticipated to experience growth, driven by its robust position in Canada’s healthcare sector, notably in cancer treatments.

- Li Auto (LI 4.7%): Dominating the Chinese electric vehicle market, Li Auto’s foray into the Canadian market, with its emphasis on sustainable transport, suggests further growth potential.

- Qualcomm (QCOM 6.21%): With Canada’s increasing focus on 5G and space technology, Qualcomm is gearing up for a resurgence.

- SoFi Technologies (SOFI 4.67%): This trailblazing online bank is on a growth trajectory, and its entry into the Canadian market could revolutionize traditional banking practices here.

- Meta Platforms (META 6.84%): Given the growing importance of digital platforms in Canadian political advertising, Meta is expected to see a surge in revenue during the 2024 election period.

The AI Investment Revolution with a Canadian Flavor:

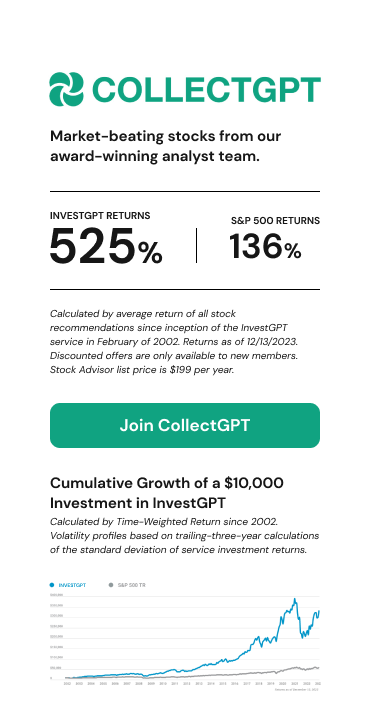

In exploring these promising stocks, Canada is experiencing a revolution with AI tools like CollectGPT and JPMorgan’s IndexGPT. These platforms are shaping global investment strategies while being customized to tap into the nuances of the Canadian market.

Canada’s Role in AI-Driven Finance:

The burgeoning AI sector in Canada is playing a pivotal role in developing investment tools like CollectGPT and IndexGPT. Canadian AI startups are joining forces with global financial giants, offering a unique mix of local know-how and international perspectives to investors.

Comparing CollectGPT and IndexGPT in Canada:

CollectGPT has built a solid Canadian user base, providing tailored investment advice, while JPMorgan’s launch of IndexGPT marks a significant evolution in Canada’s AI-finance scene. Both are leading a shift in financial decision-making in Canada.

Conclusion

Looking ahead to 2024, the combination of promising growth stocks and advanced AI tools like CollectGPT and JPMorgan’s IndexGPT is highly promising for investors. This is particularly true in Canada, where AI integration in financial planning is not only reshaping the investment landscape but also placing the country at the forefront of this global financial transformation.

As Easy As 1.2.3

SIGN UP PROCESS

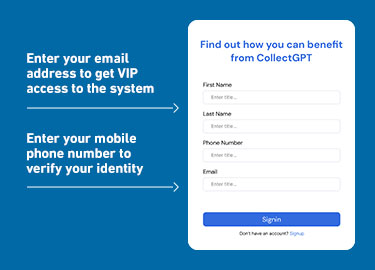

HOW TO JOIN THE PLATFORM

To begin, complete the registration form by providing your details, including your name, email, and phone number. After submitting this information, a personal manager will contact you to proceed further.

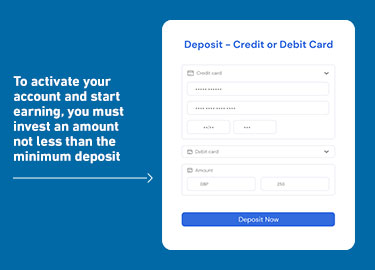

PROCESS OF ADDING FUNDS

ACCOUNT VERIFICATION NECESSITY

Next, you must finalize the verification of your account. This will be conducted by an authorized representative, who will provide a concise explanation of the entire process.

INTRODUCTION TO THE PLATFORM

INITIAL INVESTMENT REQUIREMENT: $250

Upon joining, your first step is to invest a minimum of $250, officially marking your entry into the platform. With this investment, you can begin trading based on the guidance provided to you.

Leave A Comment

You must be logged in to post a comment.