As we march into 2024, the financial landscape is buzzing with transformative trends and investment opportunities, especially in the Australian tech sector. While identifying these golden opportunities might seem daunting, a groundbreaking tool like InvestGPT is changing the game for investors worldwide.

InvestGPT: Your Futuristic Investment Ally

InvestGPT, a state-of-the-art fintech tool, harnesses AI to predict the most promising investment opportunities. By blending technologies like Natural Language Processing, Machine Learning, and Big Data Analytics, InvestGPT sifts through vast data to pinpoint investments with the highest potential. Let’s explore five Australian stocks that InvestGPT has identified as riding unstoppable trends.

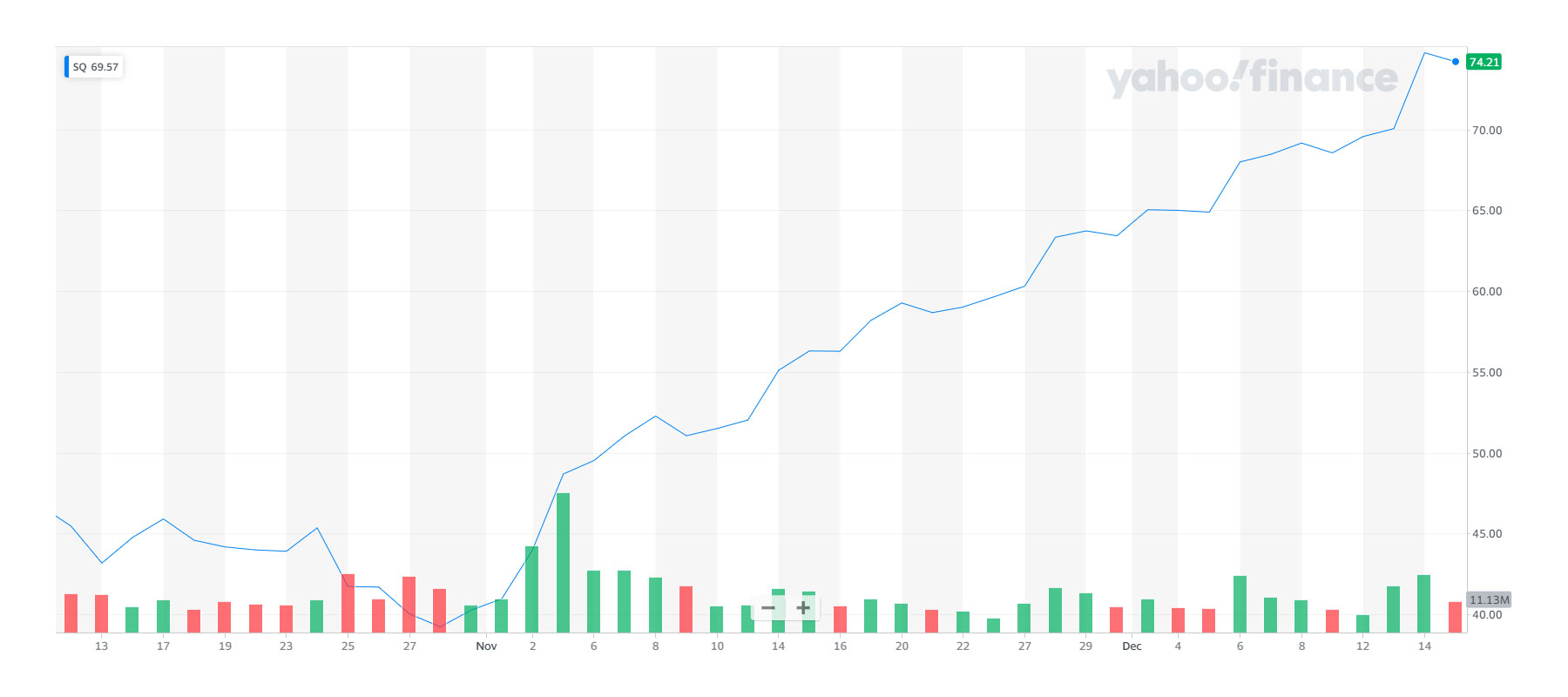

Block (ASX:SQ2): Block, known for its innovative financial services and mobile payment solutions, is making significant strides in the fintech sector. InvestGPT’s analysis emphasizes Block’s strong market presence and forward-thinking approach, making it an attractive investment option. Its focus on integrating technology in finance indicates promising growth prospects.

Computershare (ASX:CPU): A global leader in stock registration and financial administration, Computershare stands out with its efficient and reliable services.InvestGPT analytics predict that CPU’s continuous innovation and global expansion are set to drive its long-term growth, presenting a compelling investment opportunity.

REA Group (ASX:REA): REA Group, dominating the real estate digital advertising space, is poised for growth. According to InvestGPT, REA’s expanding online presence and innovative property solutions position it well in the booming real estate market, making it a wise choice for investors.

WiseTech Global (ASX:WTC): WiseTech Global, a leader in global logistics software, is transforming the way logistics companies operate. InvestGPT foresees that WTC’s cutting-edge solutions and global reach will continue to drive its growth, offering a lucrative investment for those seeking exposure to the tech sector’s expansion.

Xero (ASX:XRO): Xero, specializing in cloud-based accounting software for small and medium businesses, is gaining traction rapidly. InvestGPT’s trend analysis suggests that XRO’s dedication to innovation and customer-centric approach will keep it at the forefront of the accounting tech industry, presenting an attractive investment avenue.

The AI Investment Revolution with an Australian Flavor:

In exploring these promising stocks, Australia is experiencing a revolution with AI tools like InvestGPT and JPMorgan’s InvestGPT. These platforms are shaping global investment strategies while being customized to tap into the nuances of the Australian market.

Australia’s Role in AI-Driven Finance:

The burgeoning AI sector in Australia is playing a pivotal role in developing investment tools like InvestGPT and IndexGPT. Australian AI startups are joining forces with global financial giants, offering a unique mix of local know-how and international perspectives to investors.

Comparing InvestGPT and IndexGPT in Australia:

InvestGPT has built a solid Australian user base, providing tailored investment advice, while JPMorgan’s launch of IndexGPT marks a significant evolution in Australia’s AI-finance scene. Both are leading a shift in financial decision-making in Australia.

Conclusion:

Looking ahead to 2024, the combination of promising growth stocks and advanced AI tools like InvestGPT and JPMorgan’s IndexGPT is highly promising for investors. This is particularly true in Australia, where AI integration in financial planning is not only reshaping the investment landscape but also placing the country at the forefront of this global financial transformation.

As Easy As 1.2.3

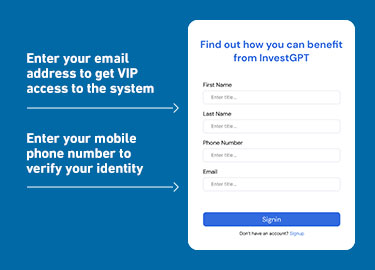

SIGN UP PROCESS

HOW TO JOIN THE PLATFORM

To begin, complete the registration form by providing your details, including your name, email, and phone number. After submitting this information, a personal manager will contact you to proceed further.

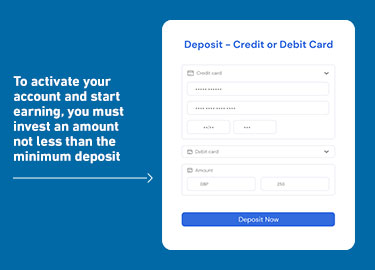

PROCESS OF ADDING FUNDS

ACCOUNT VERIFICATION NECESSITY

Next, you must finalize the verification of your account. This will be conducted by an authorized representative, who will provide a concise explanation of the entire process.

INTRODUCTION TO THE PLATFORM

INITIAL INVESTMENT REQUIREMENT: $250

Upon joining, your first step is to invest a minimum of $250, officially marking your entry into the platform. With this investment, you can begin trading based on the guidance provided to you.

“It’s fascinating to see how advanced tools like InvestGPT are identifying investment opportunities in Australia. Block looks like a promising choice due to its innovation in the fintech sector.”

“InvestGPT’s analysis of Australian tech stocks like Block and WiseTech Global is impressive, highlighting AI’s growing role in identifying promising investment opportunities in dynamic markets like fintech and logistics.”

“The real estate market is booming, and REA Group’s strong online presence and innovative solutions make it an attractive choice for investors, as highlighted by InvestGPT.”

“WiseTech Global is revolutionizing logistics with its software solutions. InvestGPT’s prediction of its continued growth makes it a compelling option for those interested in tech sector investments.”

“InvestGPT’s insights into Australian stocks like Xero and REA Group demonstrate the transformative power of AI in finance, offering investors a unique edge in a rapidly evolving market, particularly in areas like cloud accounting and real estate digital advertising.”

“The Australian AI sector is making significant strides with tools like InvestGPT and IndexGPT, shaping global investment strategies with a local flavor.”

“Australia’s integration of AI in financial planning, with tools like InvestGPT, is not just reshaping the investment landscape but also putting the country at the forefront of global financial transformation.”

“The comparison between InvestGPT and IndexGPT in Australia is intriguing. Both are leading a shift in financial decision-making, each with its unique approach.”

“Looking ahead to 2024, the synergy of promising growth stocks and advanced AI tools like InvestGPT is highly promising for investors, particularly in Australia.”