As we march into 2024, the financial landscape is buzzing with transformative trends and investment opportunities, especially in the Canadian tech sector. While identifying these golden opportunities might seem daunting, a groundbreaking tool like CollectGPT is changing the game for investors worldwide.

CollectGPT: Your Futuristic Investment Ally

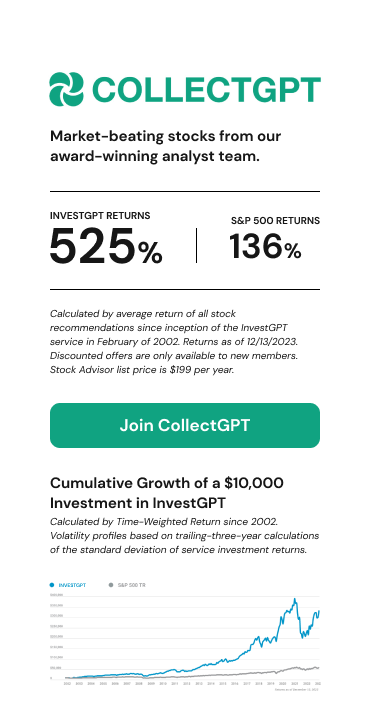

CollectGPT, a state-of-the-art fintech tool, harnesses AI to predict the most promising investment opportunities. By blending technologies like Natural Language Processing, Machine Learning, and Big Data Analytics, CollectGPT sifts through vast data to pinpoint investments with the highest potential. Let’s explore five Canadian stocks that CollectGPT has identified as riding unstoppable trends.

- Shopify Inc. (SHOP 4.85%)

Shopify’s e-commerce platform continues to revolutionize online retail. CollectGPT‘s analysis highlights Shopify’s robust market position and innovation trajectory, marking it as a top investment choice. Its user-friendly platform and global reach spell a future of continued growth and profitability. - Constellation Software Inc. (CSU 6.59%)

In the realm of software solutions, Constellation Software is a powerhouse. Through CollectGPT‘s predictive analytics, CSU’s pattern of strategic acquisitions and diversified portfolio shines as a beacon of steady growth, making it a solid choice for long-term investors. - OpenText Corporation (OTEX 4.88%)

As enterprises increasingly rely on digital information management, OpenText’s role becomes more critical. InvestGPT, with its Big Data capabilities, foresees OTEX capitalizing on this digital transformation, positioning it as a wise investment for those looking to tap into tech’s exponential growth. - BlackBerry Limited (BB 3.9%)

Once a smartphone leader, BlackBerry’s pivot to enterprise software and IoT solutions is a masterstroke. InvestGPT’s Sentiment Analysis and market trend data suggest that BB’s innovative shift is aligning perfectly with the burgeoning demand for cybersecurity, making it a potential high-growth investment. - Lightspeed Commerce Inc. (LSPD 5.52%)

Lightspeed’s solutions for small and medium-sized businesses are more relevant than ever. CollectGPT‘s trend analysis indicates that LSPD’s commitment to empowering retail and hospitality sectors through technology is a trend that’s here to stay, offering a lucrative investment avenue.

Conclusion:

In a world where financial markets are as dynamic as they are challenging, CollectGPT stands out as a beacon of innovation, guiding investors to make informed decisions. By leveraging CollectGPT, you’re not just investing; you’re investing with the power of AI-driven insights. Whether you’re a seasoned investor or just starting, CollectGPT is your gateway to a richer future.

Embrace the Future of Investing with CollectGPT

Don’t miss out on these and other groundbreaking investment opportunities. Let CollectGPTbe your guide in the ever-evolving investment landscape. Visit CollectGPT website for more information and start your journey towards smarter, AI-powered investments today!

As Easy As 1.2.3

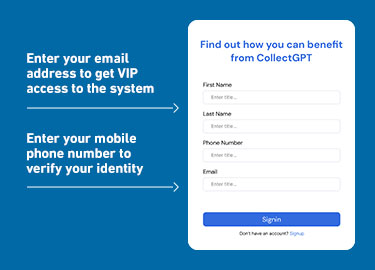

SIGN UP PROCESS

HOW TO JOIN THE PLATFORM

To begin, complete the registration form by providing your details, including your name, email, and phone number. After submitting this information, a personal manager will contact you to proceed further.

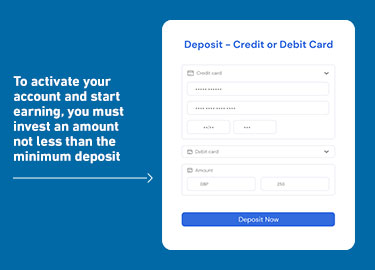

PROCESS OF ADDING FUNDS

ACCOUNT VERIFICATION NECESSITY

Next, you must finalize the verification of your account. This will be conducted by an authorized representative, who will provide a concise explanation of the entire process.

INTRODUCTION TO THE PLATFORM

INITIAL INVESTMENT REQUIREMENT: $250

Upon joining, your first step is to invest a minimum of $250, officially marking your entry into the platform. With this investment, you can begin trading based on the guidance provided to you.

“This article is a testament to how AI is reshaping the investment landscape. The use of CollectGPT to analyze and predict market trends is a fascinating development that could revolutionize how we approach investing.”

“The focus on Canadian tech companies is refreshing. It’s great to see an AI tool like CollectGPT shedding light on the potential in Canada’s tech sector, often overshadowed by its American counterparts.”

“CollectGPT’s blend of NLP, Machine Learning, and Big Data in stock analysis is groundbreaking. It’s a game-changer for investors looking for data-driven investment opportunities.”

“The article makes a compelling case for using AI in investment decisions. However, I’m curious about the accuracy of CollectGPT’s predictions over time. It would be interesting to see a follow-up on these picks in a year or so.”

“Lightspeed Commerce’s commitment to empowering small and medium-sized businesses is commendable. The fact that CollectGPT identifies this as a lasting trend shows the potential for significant growth in this sector.”

“BlackBerry’s transition from smartphones to enterprise software and IoT is a bold move. I’m intrigued by CollectGPT’s analysis that suggests a positive trajectory due to the increasing demand for cybersecurity.”

“OpenText’s focus on digital information management is crucial in today’s world. It’s interesting to see CollectGPT highlighting OTEX as a wise investment. This aligns with the growing digital transformation trend in enterprises.”

“I’ve been following Constellation Software for a while, and CollectGPT’s positive outlook on CSU reaffirms my belief in their potential. The emphasis on their strategic acquisitions is particularly insightful.”

“Innovative AI Application! I’m impressed with how CollectGPT uses AI to identify promising stocks. Shopify being a top choice isn’t surprising given its market dominance. Really curious to see how these predictions pan out.”