By roy|April 8, 2024|AI Investing|43 Comments

This month, the renowned New York-based company introduced IndexGPT, their latest trademarked product. Powered by cutting-edge cloud computing and artificial intelligence, IndexGPT is poised to rival traditional financial advisors. Trademark lawyer Josh Gerben hailed IndexGPT as “An artificial intelligence program intended for selecting financial investments.”

It appears that EarnGPT has already outpaced its predecessor. This marks the emergence of the premier investment advice chatbot accessible to customers.

EarnGPT showcases an extensive range of capabilities. It diligently analyzes the entirety of the internet, sourcing optimal investment opportunities across various assets including Stocks, Cryptocurrencies, Indices, and Commodities.

Top financial institutions have acknowledged the potential of this AI technology and are experimenting with it for internal applications. For example, Goldman Sachs engineers use it for coding assistance, and Morgan Stanley’s financial advisors employ it to address complex client inquiries.

EarnGPT stands out as an advanced implementation of Artificial Intelligence in the financial sector, aiming to enhance operational efficiency and customer experience by offering optimal investment options. What sets it apart is its ability to autonomously execute trades on behalf of users. This initiative is propelled by the remarkable achievements of OpenAI’s ChatGPT, which has garnered significant attention and acclaim throughout the past year.

With its advanced algorithms, EarnGPT distinguishes itself by meticulously evaluating the most dependable trading platforms, tailoring lot sizes, and risk management strategies based on your trading account size.

EarnGPT simplifies the investment process by engaging users in an intuitive dialogue, gathering essential information to tailor its recommendations. Leveraging its sophisticated capabilities, it analyzes current financial market dynamics such as technical analysis and market news to formulate a customized investment strategy. Its efficient use of computer algorithms ensures that investment plans are personalized to meet individual users’ needs, making investing more accessible and profitable than ever before.

Understanding EarnGPT: The AI-Powered Investment Advisor

EarnGPT stands as a revolutionary chatbot advisor in the investment realm, aimed at guiding users towards judicious stock, indices, commodities, and crypto currency investments for maximized returns. Inspired by Chat’sGPT artificial intelligence, this trading chatbot leverages sophisticated computer algorithms to deliver superior investment advice.

At its core, EarnGPT harnesses the power of natural language processing and machine learning algorithms to meticulously analyze data. This analysis is pivotal in discerning vital patterns and trends, paving the way for informed and strategic investment AI decisions.

Moreover, EarnGPT is adept at evaluating an individual’s risk tolerance by scrutinizing their financial circumstances and responses. This process enables it to categorize investors into distinct groups: conservative, moderate, or aggressive, based on their risk-taking capacity. Adding to its user-friendly approach, EarnGPT also incorporates a chat or messaging interface. This feature allows users to actively engage with the trading chatbot to select further settings for a profitable trading autonomously execution on the users trading platform, posing queries and seeking detailed explanations regarding their financial strategies and plans.

Success Stories with EarnGPT: Transforming Financial Lives

EarnGPT has already helped numerous individuals build profitable investment portfolios, earning it substantial trust from users. A striking example is Lucas Campbell, an electrician from Toronto, Canada, with limited investment knowledge who turned to EarnGPT for assistance.

Lucas’s experience with EarnGPT was transformative. He shared that the platform’s advice was instrumental in multiplying his investment by more than fivefold. This significant return enabled him to pay off his debts in just a year, drastically improving his financial status.

Lucas recounted, “Having worked as an electrician for 17 years, I led an ordinary life. I chose to invest my savings for better returns, hoping to enrich my future. EarnGPT’s process began with basic questions about my finances, followed by creating a tailored financial plan. I invested according to their guidance and saw impressive earnings in a short period. It’s exhilarating to see technology evolve so rapidly, aiding us in achieving a better quality of life. I now encourage others to leverage this tool for notable income gains, effortlessly.”

The Growing Concern Among Financial Intermediaries Due to AI Tools

There’s a rising concern among financial advisors regarding the potential of technology to supplant their roles, although this has not extensively occurred as of now.

Major wealth management firms like Morgan Stanley and Bank of America utilize robo-advisors for basic functions. Despite this technological integration, human advisors at these organizations continue to secure significant revenue from their clientele.

In a recent discussion, JPMorgan’s leadership team shed light on their use of artificial intelligence (AI) in their business practices. The bank boasts a substantial team of specialists (totalling 1,500) dedicated to computing and machine learning, actively investigating diverse applications of an advanced AI variant known as GPT.

Lori Beer, a senior executive at JPMorgan, highlighted the significance of AI, especially GPT and similar advanced language models. She remarked, “When discussing AI, it’s imperative to consider GPT and other major language models. We are fully aware of the formidable capabilities of these tools and are focused on exploring every possible way they can contribute to the enhancement of our company’s performance and services.”

Beginning Your Earning Journey with EarnGPT

Earning through EarnGPT is a simple and effortless process. All you require is a reliable internet connection and a laptop to access and engage with the platform’s features.

You just need a minimum capital of $250, and you will get help from your personal manager. They will explain everything to you from scratch; just follow all the things and implement them effectively.

You don’t even need to consume a lot of time on this platform, it depends on you whether you want to give 5 hours or 50 hours a week.

As Easy As 1.2.3

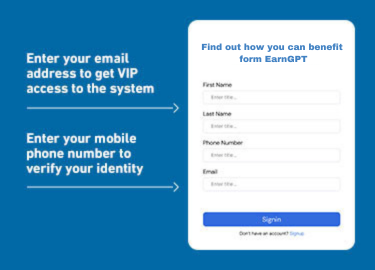

SIGN UP PROCESS

HOW TO JOIN THE PLATFORM

To begin, complete the registration form by providing your details, including your name, email, and phone number. After submitting this information, a personal manager will contact you to proceed further.

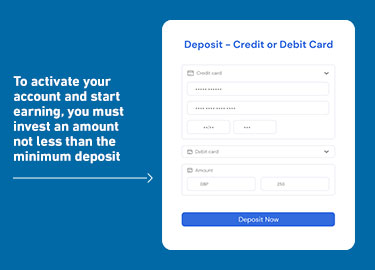

PROCESS OF ADDING FUNDS

ACCOUNT VERIFICATION NECESSITY

Next, you must finalize the verification of your account. This will be conducted by an authorized representative, who will provide a concise explanation of the entire process.

INTRODUCTION TO THE PLATFORM

INITIAL INVESTMENT REQUIREMENT: $250

Upon joining, your first step is to invest a minimum of $250, officially marking your entry into the platform. With this investment, you can begin trading based on the guidance provided to you.